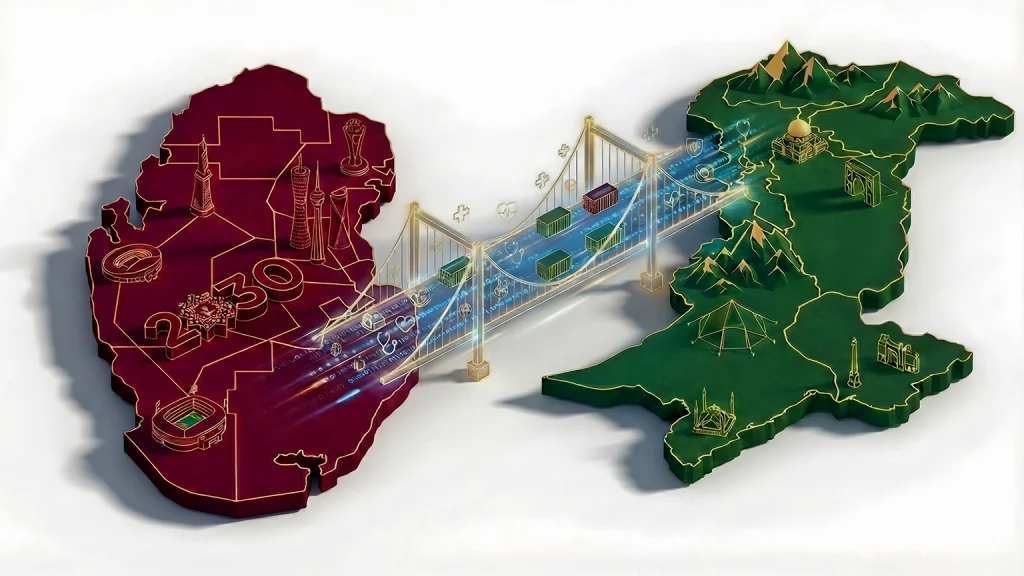

Have you ever dreamed of taking your Pakistani company to the Gulf, but got confused by all the rules and paperwork? Don’t worry – you’re not alone! GCC business expansion planning is now easier than ever in 2026. More Pakistani businesses are opening offices in Dubai, Riyadh, and Doha than ever before. This detailed guide explains everything in very simple words – from 100% ownership to taxes and visas. Let’s make your Gulf dream come true!

Why Pakistani Businesses Are Targeting GCC in 2026

Pakistani companies love the GCC right now. Why? Simple. Oil money is turning into malls, tech parks, hospitals, and tourism. Saudi Arabia, UAE, and Qatar need everything Pakistan is good at – textiles, IT, food, construction, and healthcare. Moreover, flights are short and cheap. The time zone is almost the same.

Here are the top 5 reasons Pakistani owners tell us daily:

- Big projects under Saudi Vision 2030

- Dubai Expo effect still going strong

- Qatar is still building after the World Cup

- Zero or low income tax

- Easy family visa and top schools

That’s why smart Pakistani businessmen start GCC business expansion planning today.

Country-by-Country Regulatory Comparison

| Country | 100% Foreign Ownership | Mainland/ Only Freezone | Key License Body | Minimum Capital |

| UAE | Yes (most sectors) | Both | DED / Freezone | Zero in many free zones |

| Saudi Arabia | Yes (most sectors) | Both | MISA | Zero – 500K SAR |

| Qatar | Yes except few | Both (New Law) | Ministry of Commerce | QAR 200,000 |

| Oman | Yes in 2000+ activities | Both | Ministry of Commerce | Zero – OMR 150K |

| Bahrain | Yes (most sectors) | Both | Ministry of Industry | Zero – BHD 50 |

| Kuwait | 100% in selected only | Mostly need local partner | MOCI | KD 1,000 |

UAE – 100% Ownership & Mainland vs Free Zone

Everyone starts with UAE company formation. Good news – since 2021, you can own 100% in almost every business on the mainland, too. Free zones are still popular because a visa and office package is ready in 2 days. But if you want to sell inside the UAE, the mainland is better now. Popular free zones for Pakistanis are DMCC, Jebel Ali, Sharjah, and Ajman. Need help choosing? Talk to our AIBN’s market entry strategy team, as they are experienced professionals.

Saudi Arabia – SAGIA to MISA Changes & Premium Residency

The old name was SAGIA; now it’s MISA. They made everything online and super fast. Saudi Vision 2030 compliance is easy – show your business helps Saudi goals (jobs for Saudis, tech transfer, etc.). Big bonus: Premium Residency (like Golden Visa) is now open for investors.

Qatar – Latest Sponsorship Law Updates

Qatar removed the kafala (sponsorship) system long ago. Now, any foreigner can change jobs easily. For companies, the new law says 100% foreign ownership is allowed in all sectors except banks and real estate agencies. Doha is perfect for Pakistani trading and contracting companies. We help many clients with Qatar joint venture facilitation every month.

Oman – Full Foreign Ownership Allowed Sectors

Oman’s 100% ownership came in 2021. More than 2,000 activities are now fully open. No minimum capital is now required in most cases, which is great for logistics and tourism businesses. Muscat and Salalah ports are growing very fast.

Bahrain & Kuwait – Key Differences

Bahrain is the easiest and cheapest. A Bahrain business license costs almost nothing and is ready in one week. While Kuwait still follows the Kuwait foreign investment law, you need a 51% Kuwaiti partner in most cases. Only some industrial projects get 100%.

Common GCC-Wide Compliance Requirements

Some rules are the same in all six countries. Let’s see the important ones.

VAT, Zakat, & Corporate Tax Overview

- UAE, Saudi Arabia, Bahrain, Oman have 5% VAT

- Qatar will start VAT in 2026

- No personal income tax anywhere

- Zakat and tax GCC – Muslim-owned companies pay 2.5% Zakat in Saudi & Bahrain

Anti-Money Laundering (AML) & Ultimate Beneficial Owner (UBO)

Every country now asks for a beneficial ownership register. You must tell the real owner’s name (even if the company is in Panama or BVI). Anti-money laundering GCC rules are very strict. A bank account will not open without a UBO form. Our legal & compliance frameworks team fills this for you in one day.

Other common rules include:

- Economic substance regulations (you must have a real office and staff)

- ICC arbitration GCC clauses are accepted everywhere

- GCC customs union – one customs paper for all six countries

Step-by-Step GCC Expansion Checklist for Pakistani Companies

Ready to start? Follow this simple list

- Research your sector and the best country.

- Make a plan – use our feasibility studies.

- Pick structure – 100% own or joint.

- Get licenses – like MISA or a free zone.

- Handle taxes – VAT, corporate, Zakat.

- Open a bank account and office.

- Hire staff – follow local job rules.

- Start marketing – use B2B matchmaking & networking.

Need someone to do all this for you? Book our free consultation today.

Conclusion

GCC business expansion planning in 2026 is the best chance for Pakistani companies. Rules are friendly, 100% ownership is allowed in most places, and profit is tax-free. Need the right partner for connecting to strategic opportunities across continents? AIBN has helped 350+ Pakistani firms to open their Gulf business. We know every rule, every GCC regulatory compliance standard, and every bank manager. From B2B matchmaking to cultural training, we make everything smooth & stress-free. Contact AIBN today for personalized support on your Qatar/GCC expansion.

FAQs

Can Pakistani citizens own a 100% company in the UAE?

Yes! Since 2021, 100% foreign ownership is allowed in 1,000+ activities on the mainland and all free zones. Only a few sectors, like oil and defense, are restricted.

Is the sponsor still needed in Qatar?

No. Qatar ended the kafala system. New sponsor exit rules let you change jobs or bring family easily.

How long bank account opening takes?

With proper UBO and anti-money laundering GCC papers, 3–15 days. We, at AIBN, have a 95% success rate.

Can I bring my family immediately?

Yes. Once you get a residence visa (1–4 weeks), you can sponsor your wife, children, and parents.

What is the cheapest GCC country to start a business in?

Bahrain is the cheapest GCC country to start a business in. UAE, Ajman, or RAK free zones are also very affordable.

Do I need Arabic in documents?

Only court or marriage papers need Arabic. All company papers can be in English. We translate if required.

Is the GCC customs union helpful for trading companies?

Yes, very much! One customs declaration and 5% duty for all six countries. Goods move freely inside the GCC.

How is AIBN different from other consultants?

We are a Pakistani team living in GCC for 10+ years. We speak Urdu, English, Arabic, know culture, and give a fixed price – no hidden fees. Plus, we provide professional support and guidance throughout your journey!