Entering the GCC markets offers huge opportunities for growth. You face growing economies like the UAE, Saudi Arabia, and Qatar, where non-oil sectors drive growth at around 4-4.5%. However, success begins with good planning. Market research GCC comes in there. It turns your ideas into intelligent actions. In its absence, you are likely to make huge errors. This guide takes you through each step. We will discuss such important sections as how to collect insights, pitfalls to avoid, and prosper. By the close, you will have a clear action plan of entry in 2026. Let’s dive in.

Why Market Research GCC is Critical for Your Success

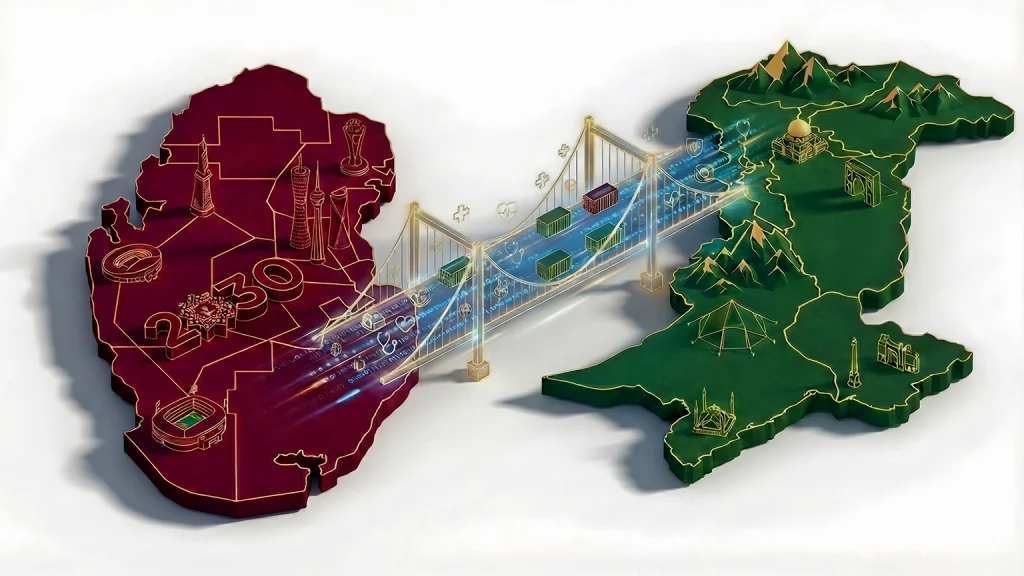

Imagine jumping into a new market blindfolded. Sounds risky, right? Market research GCC helps you see clearly. It identifies opportunities and shuns traps. The GCC has gigantic potential for Pakistani firms. According to the latest statistics, trade between Pakistan and the GCC reached several billion dollars last year. However, cultural differences and regulations can get you. Good research eliminates those risks. We have assisted more than 60 Pakistani companies in joining the GCC regions. Discover how we support Pakistan GCC business consulting and full market entry. It boosts your chances by 50%, turning guesswork into wins. Don’t skip it—your business depends on it.

5 Core Components of GCC Market Analysis

Dive into these five pillars for strong research, as they build a full picture of the market.

1. Market Sizing & Demand Validation

First, figure out how big the market is. Refer to such tools as market sizing Middle East reports by the World Bank, or local chambers. Confirm demand by ensuring that your product fits. A Pakistani food exporter may find a lot of demand for halal products in the UAE. Tools? Surveys and trade data. This will be done to make sure that your idea has actual buyers.

2. Competitive Landscape Assessment

Know your rivals. Map out who dominates. In Dubai, research local retail players. Competitive intelligence in the UAE should be used to collect pricing and strategy data. Tools like SWOT help here. Where you shine, where you shine, such as better quality, Pakistan.

3. Regulatory & Compliance Requirements

Rules matter a lot in the GCC. Each country has unique laws. Saudi Arabia needs local partners in certain sectors. Explore the regulatory environment of GCC through government websites. You can obtain our regulatory compliance research to obtain legal assistance. Escape fines through early planning. Let our experts handle Policy & Regulatory Navigation for smooth GCC expansion from Pakistan.

4. Distribution Channels & Partner Mapping

How will you get products to customers? Identify distributors and logistics. In Qatar, partner with local firms for a smooth entry. Conduct distributor interviews to build networks. Our Partnership & Alliance Building service connects you directly with verified Qatar and GCC partners.

5. Consumer Behavior & Cultural Insights

Understand buyers. Consumer behavior in Saudi Arabia shows a preference for quality over price in luxury goods. Use insights to tailor products. Respect cultural norms, like modest packaging in conservative areas.

Primary vs Secondary Research Methods for GCC

Choose the right mix. Primary research methods involve fresh data, like surveys or interviews. They’re great for specific insights. For instance, run focus group GCC sessions to test ideas. Survey design in Arabic ensures accuracy in local languages. Our bilingual team handles this well.

Secondary data sources use existing information. Grab GCC industry reports from chambers or government databases. Check trade statistics import export for trends. Blend both for the best results. Primary adds depth, secondary saves time.

Here’s a quick comparison table:

| Aspect | Primary Research | Secondary Research |

| Data Type | Original, custom | Existing, public |

| Cost | Higher | Lower |

| Time | Longer | Faster |

| Examples | Interviews, surveys | Reports, databases |

| Best For | Specific questions | Broad overviews |

Country-Specific Research: Qatar, UAE, & Saudi Arabia

Tailor your approach per country. In Qatar, the focus is on energy and infrastructure. Conduct a feasibility study in Qatar to check viability. Our Doha presence gives direct access. For the UAE, emphasize innovation hubs like Dubai. Use competitor analysis in Dubai for an edge. Saudi Arabia pushes Vision 2030—align with that. Dive into consumer trends there.

For in-depth help, explore our comprehensive feasibility studies. We’ve done 60+ across GCC.

Step-by-Step Competitor Analysis Framework

Here’s a simple table to guide your framework:

| Step | Action | Tools Needed |

| 1 | Identify Competitors | Online searches, industry lists |

| 2 | Collect Data | Websites, reports, interviews |

| 3 | SWOT Analysis Framework | Templates, team brainstorming |

| 4 | Find Opportunities | Gap mapping, customer feedback |

| 5 | Ongoing Monitoring | Alerts, quarterly reviews |

For GCC, track UAE innovators or Saudi locals. Need pros? AIBN’s professional competitive analysis delivers deep insights.

Market Research Timeline & Budget (90-Day vs 6-Month)

Time it right. A 90-day sprint suits quick entries. Compare in this table:

| Aspect | 90-Day Plan | 6-Month Plan |

| Scope | Basic insights | In-depth, with testing |

| Cost | Low | Higher |

| Best For | Fast validation | Complex sectors |

| Risks | Miss nuances | Higher expense |

Common Research Mistakes to Avoid in GCC

Don’t ignore culture—that’s huge. Assuming the English language works everywhere? Wrong. Use Arabic for surveys. Over-reliance on secondary data; mix in primary. Skip industry associations Middle East—they offer gold. Underestimate regulations; always check. Finally, no follow-up? Research evolves.

Learn from these:

- Neglect localization: Always translate surveys.

- Skip compliance: Research rules early.

- Ignore feedback: Listen to consumers.

- Poor budgeting: Plan for extras like travel.

How AIBN Delivers Market Entry Research

We are Pakistan’s premier gateway to the GCC. At AIBN, our team specializes in bilingual surveys, field visits, and leveraging exclusive networks. Our services include market entry research, feasibility studies in Qatar, and beyond. Explore our dedicated Qatar market entry from Pakistan solutions. With an on-ground presence in Doha, we provide real-time market intelligence. We hold strategic collaborations with the Qatar Chamber and Metas Qatar, and to date, AIBN has successfully initiated over 19 businesses in sectors like healthcare and construction.

Get access to exclusive networks for distributor interviews. Bilingual experts do survey design in Arabic. Professional market research is available now at AIBN. We have done research on food industries, and we have made sure that it is compliant. A single call is all it takes to get a free consultation.

Final Words

Let’s wrap up in simple words. Start with objectives. Mix primary/secondary methods. Use trade stats import export for data. Join industry associations in the Middle East for networking. Analyze with SWOT. Turn insights into action with strategic positioning. Collaborate with industry players such as AIBN to position strategically in the market. Keep in mind that market research GCC is your ticket to success in 2026.

FAQs

What is the first step in market research, GCC?

Begin by setting your goals. As a Pakistani exporter, target market identification and the product fit in the UAE. Next, gather secondary data from GCC government databases. This forms a foundation prior to major techniques such as surveys. Have specific objectives to work towards.

How long does a feasibility study in Qatar take?

Typically, it takes 4-8 weeks. It involves market sizing, demand checks and financial projections. In the case of the expanding economy of Qatar, consider factor alliances. Our group accelerates it using domestic networks. Demand in-depth risk and opportunity reports. Learn more about our feasibility studies and business expansion in Qatar from Pakistan.

Why use competitive intelligence in the UAE?

It unveils the strategies of rivals in dynamic markets in the UAE. Examine pricing, marketing, and weaknesses. One of the Karachi companies may identify loopholes in technology services. Tools like SWOT help. This knowledge gives you an advantage of entry.

What affects consumer behavior in Saudi Arabia?

Cultural values, income levels, and Vision 2030 drive it. Saudis prefer quality brands with halal certifications. Use focus groups to understand preferences. Economic growth boosts spending on luxuries. Tailor products accordingly.

How to find industry reports for the GCC?

Get them through chambers of commerce or through sites such as the World Bank. Qatar Chamber provides free ones. For paid, try Statista. They include industries such as oil and retail. Use for trends and forecasts.

What are the key primary research procedures for GCC?

Surveys, focus groups, and interviews are the best. In Arabic-speaking regions, question translation. Field trips provide first-hand information. As an example, discuss with distributors in Dubai. Add depth with observation. We have a bilingual team that will guarantee the proper collection of data without language barriers.

How to use secondary data sources in research?

Pull from trade stats, reports, and databases. Sites like UN Comtrade offer import-export info. Analyze for patterns. It’s quick and cheap. Supplement with primary for freshness. For GCC, check local ministry sites.

What’s a good focus group in the GCC setup?

Gather 8-10 diverse participants. Discuss in neutral spots. Use Arabic moderators for comfort. Topics: product likes and cultural fits. Record insights on buying habits. Follow up with surveys for more data. This reveals hidden preferences.